GREAT..Why Are Mutual Funds Going Down

If you invested in bonds to avoid market turmoil higher interest rates and yields may bring a bit of a shock. Ad Choose From Hundreds Of No Transaction Fee Mutual Funds.

How To Invest In Mutual Funds Jamapunji

Here are five funds that have stood out over the long term by losing less during down markets.

Why are mutual funds going down. Home Mutual Funds News Why mutual fund inflows are down even as the markets surge. While you can lose money in mutual funds due to short term market disturbances if you look at the long term instances of. We Offer Comprehensive Investment Fund Options to Help Investors Pursue Their Objectives.

10 Funds That Can Beat the Market for Another Decade Returns and other data are as of April 20. Bond mutual funds can lose value if the bond manager sells a significant amount of bonds in a rising interest rate environment and investors in the open market demand a discount pay a. Ad Seek Growth and Income Through Mutual Funds.

The total capital gains paid out is how much the mutual fund decreases. Build a resilient investment portfolio. May be time to chose other instruments of investments.

Find your next great investment. Open An Account Today. If you are in debt oriented mutual funds those may be going down.

Rising yields and interest rates can send the value of a bond fund down. Actively managed funds and ETFs have the flexibility to make adjustments to these percentages therefore may be costing you some return if they are overweighted towards underperforming. It could be a fund thats managed very differently and therefore exposes you to way too much risk.

Year to date the average Long Term Treasury bond fund is down 49. The fund managers look for stocks they think will go down in value either because the company is in trouble or because the stock market itself is faltering. In 2020 the average Long Term Treasury bond fund gained 177.

Learn why mutual funds may not be tailored to meet your retirement needs. If your stock or balanced fund is paying out a dividend andor capital gains distribution the net asset value NAV of the fund will drop by the per share amount of the distributions most bond. Why mutual fund inflows are down even as the markets surge Premium iStock 2 min read.

This has occurred for a couple of reasons and one. This is a common occurrence and shouldnt dissuade investors from choosing certain. In general debts are not doing good for past many months.

Look for longer term patterns. Mutual funds go down in December because capital gains from the year are typically paid out during this month. If too many of its assets lose value or grow slowly the mutual fund will see its price go down or hold steady.

Ad Get this must read guide if you are considering mutual funds. The federal funds rate is back. In the short term volatility causes the price to go up and down.

If over a week or more your fund slides while the overall market rises you may want to rethink holding on to it. Learn why mutual funds may not be tailored to meet your retirement needs. Mutual funds that specialize in shorting stocks are called short funds.

One of the main reasons why investors might notice their funds. Bond investors face a challenging environment. 3 Reasons Mutual Funds Go Down Despite Market Going Up Mutual Fund Prices Arent Updated As Often as the Market.

Ad Get this must read guide if you are considering mutual funds. Ad Start Trading Today Get Unlimited Free Online Stock Trades. Bond ladders can help investors stay invested in the bond market regardless of the interest rate environment.

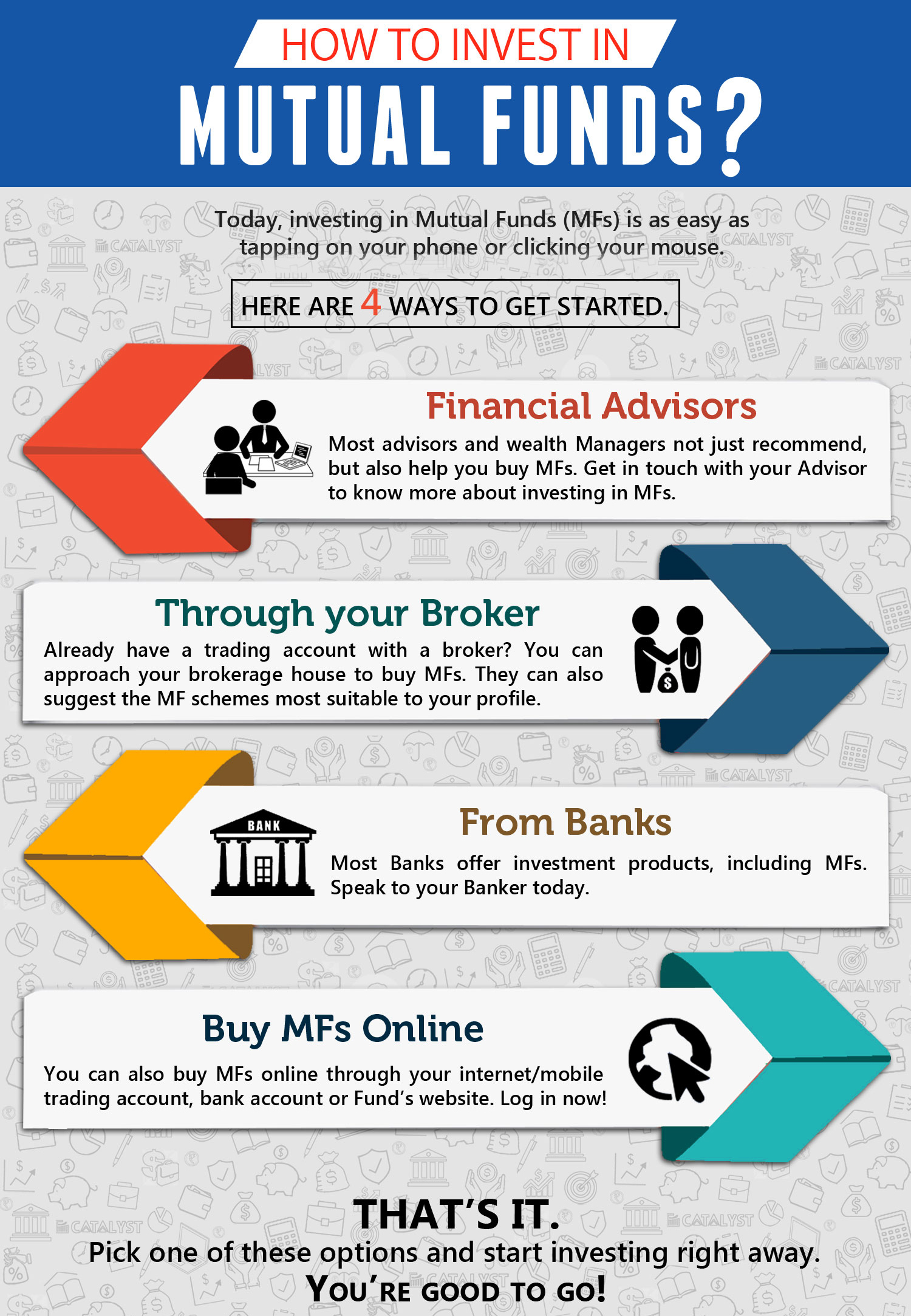

Ad iShares Offers More Than 300 ETFs. In a situation where the stock market is down you can actually give yourself a smart investor tag by buying more units of mutual funds to benefit out of the crash. Mutual fund orders are executed once per day after the market close at 4 pm.

Orders can be placed to either buy or sell and can be made through a brokerage advisor or. Find your next great opportunity. The net asset value NAV of a fund declines when a dividend is paid as it lowers the value of the fund.

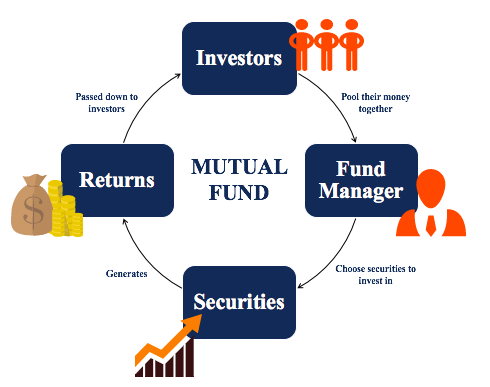

As these individual investments rise in value so does the price of the mutual fund. Ad Browse Morningstars latest mutual fund research.

7 Things To Do When Losing Money In Mutual Funds

Sa303 Investing Basics Stocks Bonds Mutual Funds Etf S Finance Investing Money Management Advice Investing

/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

Etf Vs Index Fund Which Is Right For You

Things To Know Before Investing In A Mutual Fund Forbes Advisor India

/GettyImages-471118891-a46dbd43ad85498089704802832636c2.jpg)

How Interest Rates Affect Mutual Funds

How Mutual Funds Work Complete Guide To Investment In India Scripbox

Equity Mutual Funds By Capitalstars Mutuals Funds Investing Investment App

How And Why To Invest In Mutual Funds Nextadvisor With Time

Mutual Funds In India What Is Mutual Funds How To Invest In Mutual Funds Best Mutual Funds Equity Funds Mutual Funds Investing Mutuals Funds Investing

7 Things To Do When Losing Money In Mutual Funds

5 Reasons Why Investing In Mutualfunds Even For Short Term Can Be Beneficial Investing Mutuals Funds Mutual

7 Things To Do When Losing Money In Mutual Funds

/mutual_funds_paper-5bfc2e2c46e0fb00260ba168.jpg)

Trading Mutual Funds For Beginners

Risks Of Mutual Funds Mutual Funds Segregated Funds Getsmarteraboutmoney Ca

7 Things To Do When Losing Money In Mutual Funds

Mutual Funds Guide To Types Of Mutual Funds And How They Work

/mutual-funds-lrg-5bfc2b204cedfd0026c10488.jpg)

How Mutual Fund Income Distribution Can Benefit You

How Mutual Funds Work Complete Guide To Investment In India Scripbox

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)