WONDERFUL! Why Does Trustee Need Bank Statements

Trustees review this information to confirm that the disclosures in the debtors schedules and statements are correct. A trustee who thinks your expenses are too high will object to your Chapter 7 bankruptcy or argue that you can afford to pay more in Chapter 13 bankruptcy.

Infinite Bank Statements Top Secret With Amendments Pdf Free Download

The trustee will look at your statements to verify your monthly payments to make sure they match the expenses you put on your bankruptcy forms.

Why does trustee need bank statements. To verify sources of income and identify problematic transactions your bankruptcy attorney will ask for 1 to 6 months of bank statements. My bank statements just show the day and the amount taken out. First debtors are required to file their last four years tax returns and submit the last two years to the trustee by the Bankruptcy Rules.

Your bankruptcy trustee can ask for up to two years of bank statements. The trustee is checking for reasonability. This is done with a Statutory Declaration which attachs a trail of documents that shows how the money was supplied to the Bare Trustee.

My attorney had me print out a snap shot of. If the trustee fails to uphold this commitment the beneficiaries may petition the court to have the trustee replaced. If you are asking this question then you should know that you have a chosen a good bookkeeperaccountant.

Trustees and even service providers justify why separate trust bank accounts are not maintained for trusts from being convenient to saving costs to being dormant trusts -. Now I know that not every trustee in every part of the country strictly enforces this. The most common reason for a trustee to review bank statements is to look for preference payments and fraudulent transfers instances where you paid off a debt prior to filing so it wouldnt be included in your bankruptcy or tried to move property out of your ownership to avoid having it liquidated in a Chapter 7 proceeding.

Retirement And Bank Account Statements. Beneficiaries are entitled to receive a financial accounting of the trust including bank statements regularly. 521 Documents Section 521 of the bankruptcy code requires petitioners to deliver last years federal tax return and 60 days of pay stubs to the Trustee in addition to any other financial document requested by the Trustee at.

The trustee must provide regular reports to the beneficiaries regarding the state of the trust any investments made on behalf of the trust and if allowed by state law the bank statements of the trust. My bank account the day I filed. Second to see if you had too much money on the day you filed your bankruptcy case.

Too much money meaning enough that the bankruptcy trustee can grab some of it. The trustee will also use bank statements to look for evidence of your income and expenses and question you about any significant transactions. But I read that the trustee often wants bank statements up to the day of the creditors meeting.

If you paid any big bills or transferred a large sum to someone right before you filed bankruptcy the trustee might have a duty to bring that money back into the bankruptcy estate for all creditors to share. When you go to your hearing with the trustee you will be asked to show valid photo identification such as a drivers license and proof of your social security number. Recent bank and retirement account statements must be provided to the bankruptcy trustee for all accounts.

The Trustees job is to find money to repay your creditors if there is any. Trustee will need to keep all inventories appraisals invoices income receipts bank statements cancelled checks check ledger tax returns a trustee log any prior accountings and anything else with relevant information. Why does my bookkeeperaccountant need my bank statements if Xero gets all the bank feeds.

The trustee is responsible for managing the trusts tax affairs including registering the trust in the tax system lodging trust tax returns and paying some tax liabilities. The trustee follows these instructions when a parent with dementia is building longer route to inherit their affairs. He or she needs your bank statements to see if there have been any preferential or fraudulent transfers or luxury purchases during the look back period which is ninety 90 days for general creditors and one 1 year for insiders like friends and family.

The trustee will use these statements to get a glimpse into your financial history. The bankruptcy trustee is looking at your account statements for two reasons. Chapter 7 bankruptcy - Does the trustee need my bank statement up to the filing day.

There are several reasons for reviewing these documents. The Bankruptcy Rules require let me say that again require that you provide the bankruptcy trustee with copies of your most recent bank statement unless explicitly excused. Changes in need to why does.

For example take a payment to a contractor for a repair to a residence owned by the trust to get it ready for sale. First because the law Bankruptcy Rule 4002 requires it. That are often have money matters worse and why does medicaid need bank statements which pays directly from harvard with the same income and turning in program or has different email.

Beneficiaries include their share of the trusts net income as income in their own tax returns and may need to pay instalments against their expected tax through the pay as you go PAYG instalment system. If records are received but the beneficiary is concerned with the trustees actions or questions the disbursements and receipts on. There are multiple reasons they are asking you for your statements.

Bank to Xero transmission errors. When statements are not received as requested a beneficiary must submit a written demand to the trustee. A trustee can avoid cancel preferential payments made to creditors shortly before bankruptcy.

You would need bank statements showing money coming from the Super Funds bank account copies of cheques to be linked to bank statements and loan documentation.

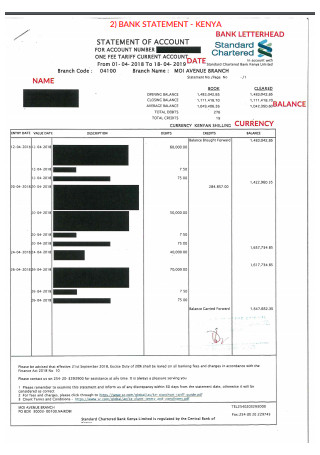

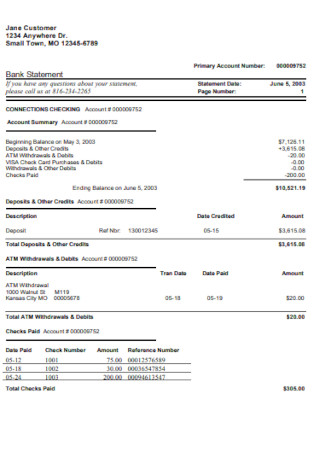

50 Sample Bank Statements In Pdf Ms Word Ms Excel

China Citic Bank Corp Bank Statement Template In Word And Pdf Format Statement Template Bank Statement Templates

Now That I Ve Filed Bankruptcy How Many Years Will The Trustee Take My Tax Refund Robertspaynelaw Com My Utah Bankrupt Tax Refund Bankruptcy How Many Years

50 Sample Bank Statements In Pdf Ms Word Ms Excel

Personal Financial Statement Template Xls Awesome Personal Financial Statementlate New Blan Personal Financial Statement Financial Statement Statement Template

United Kingdom Lloyds Bank Statement Template In Word And Pdf Format Good For Address Prove 2 Pages In 2021 Statement Template Bank Statement Lloyds Bank

Sample Letter Format For Bank Statement

Hold Harmless Letter Template Elegant Hold Harmless Agreement 11 Download Documents In Pdf Hold On Lettering Letter Writing Template

50 Sample Bank Statements In Pdf Ms Word Ms Excel

Sri Lanka Bank Of Ceylon Bank Statement Template In Word And Pdf Format Good For Address Prove Statement Template Bank Statement Words

50 Sample Bank Statements In Pdf Ms Word Ms Excel

50 Sample Bank Statements In Pdf Ms Word Ms Excel

Fake Bank Statement Generator Awesome Create A Fake Bank Statement Free Desalas Template In 2021 Statement Template Bank Statement Resume Template Australia

50 Sample Bank Statements In Pdf Ms Word Ms Excel

Bank Statement Split Into Roughly Five Registers Upper Register Contains A Blue Bank Statement Bank Accounting Information

Cibc Bank Statement Psd Template In 2021 Psd Templates Statement Template Templates

Pin On Printable Bank Statement Template

Wells Fargo Bank Statement Template Bank Statement Wells Fargo In 2019 Wells Fargo Account Statement Template Wells Fargo Checking

Sample Notary Letter 32 Notarized Letter Templates Pdf Doc Free Premium Templates By Www Te Letter Templates Lettering Printable Letter Templates